Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Last updated 10 novembro 2024

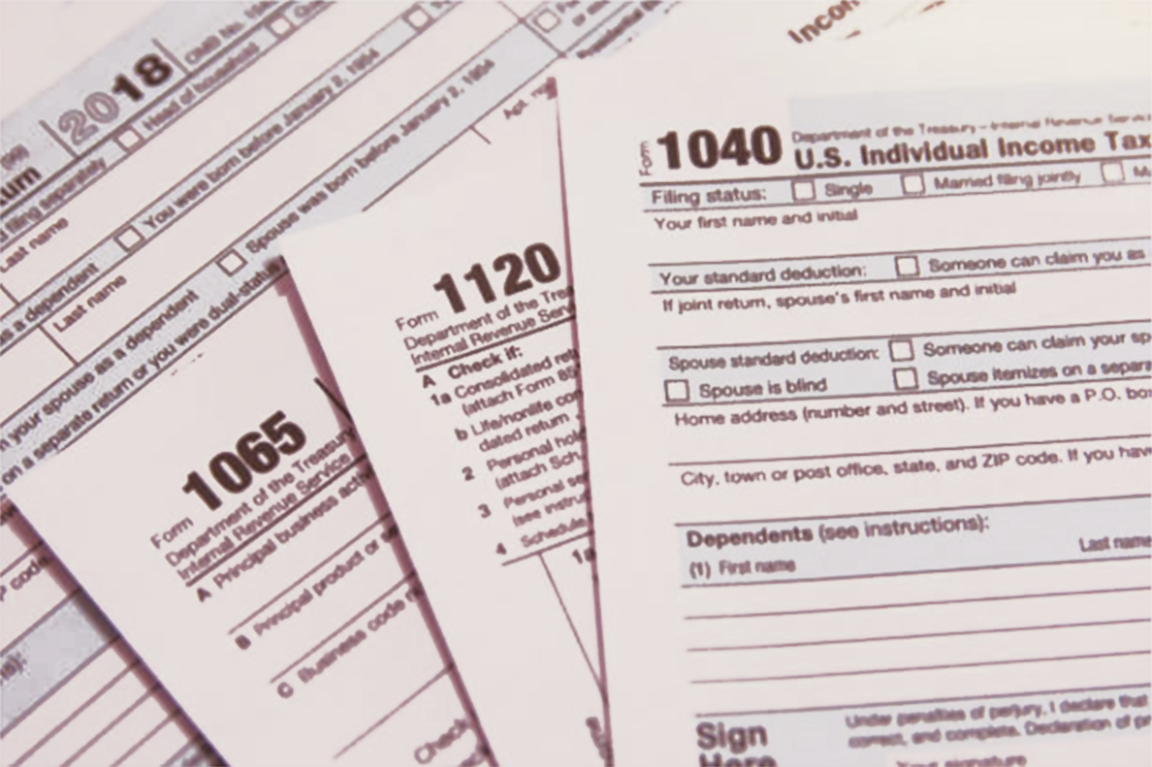

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

Proceedings, Free Full-Text

Tax reforms to raise revenue efficiently and equitably

Tackling the tax code: Efficient and equitable ways to raise

Options to Raise Tax Revenue, Tax Policy Trade-offs

Henry George's Single Tax Could Combat Inequality - The Atlantic

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

Value-Added Tax (VAT)

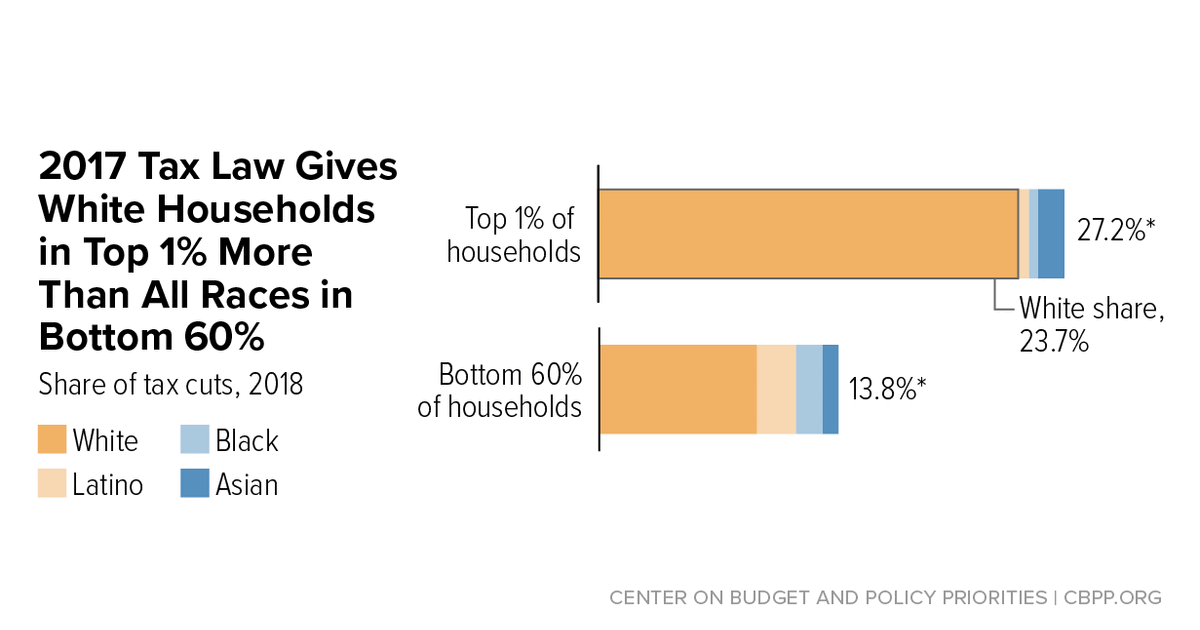

How the Federal Tax Code Can Better Advance Racial Equity

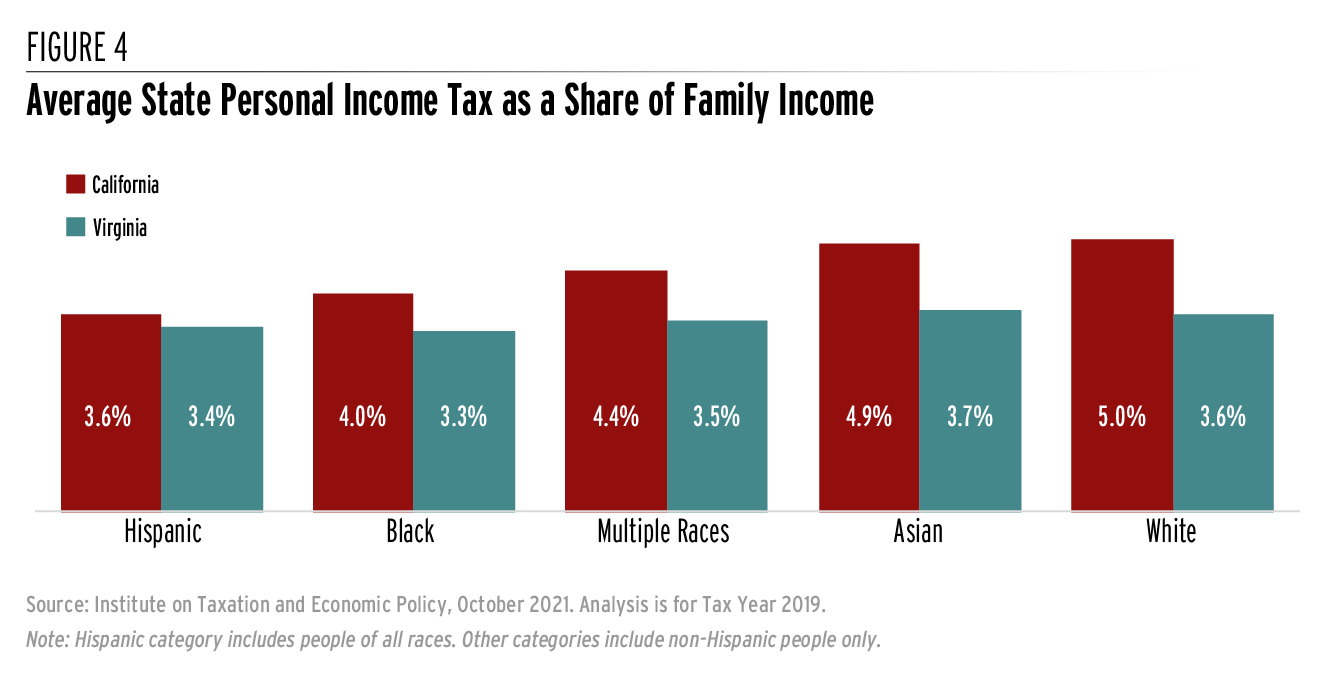

State Income Taxes and Racial Equity: Narrowing Racial Income and

Capital Reduction: Tax Conundrums!

Recomendado para você

-

The United Nations world water development report 2021: valuing water10 novembro 2024

-

Marginal Operation (Manga)10 novembro 2024

Marginal Operation (Manga)10 novembro 2024 -

Marginal Operation 1 - Marginal Operation Chapter 1 - Marginal Operation 1 english10 novembro 2024

Marginal Operation 1 - Marginal Operation Chapter 1 - Marginal Operation 1 english10 novembro 2024 -

Chapter 1110 novembro 2024

Chapter 1110 novembro 2024 -

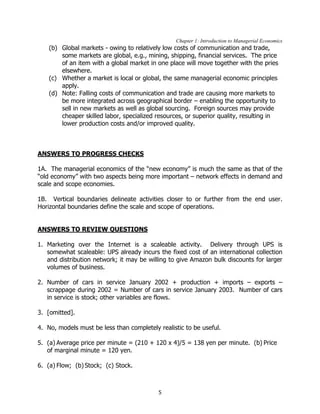

SOLUTION: Chapter 5 economic questions and answers topic efficiency and equity - Studypool10 novembro 2024

SOLUTION: Chapter 5 economic questions and answers topic efficiency and equity - Studypool10 novembro 2024 -

Marginal People in Deviant Places10 novembro 2024

Marginal People in Deviant Places10 novembro 2024 -

CFA Level 1 Economics: Our Cheat Sheet - 300Hours10 novembro 2024

CFA Level 1 Economics: Our Cheat Sheet - 300Hours10 novembro 2024 -

Introduction to Managerial Economics10 novembro 2024

Introduction to Managerial Economics10 novembro 2024 -

Chapter 5.10: Major public health problems — dental health - Agneta Ekman, 200610 novembro 2024

-

Marginal 1 - Read Marginal Chapter 110 novembro 2024

Marginal 1 - Read Marginal Chapter 110 novembro 2024

você pode gostar

-

And that's how i was baned from jojo wiki fandom, /r/ShitPostCrusaders/, JoJo's Bizarre Adventure10 novembro 2024

And that's how i was baned from jojo wiki fandom, /r/ShitPostCrusaders/, JoJo's Bizarre Adventure10 novembro 2024 -

Corrida de Carro da Barbie no Tuca Jogos10 novembro 2024

Corrida de Carro da Barbie no Tuca Jogos10 novembro 2024 -

My Home Hero Manga - Chapter 95 - Manga Rock Team - Read Manga Online For Free10 novembro 2024

My Home Hero Manga - Chapter 95 - Manga Rock Team - Read Manga Online For Free10 novembro 2024 -

Resident Evil 8: Resident Evil Village, PlayStation 410 novembro 2024

-

Sony Wants Marvel Studios To Produce Andrew Garfield's Amazing10 novembro 2024

Sony Wants Marvel Studios To Produce Andrew Garfield's Amazing10 novembro 2024 -

Olliix by Martha Stewart Morocco/Gold Holls Console Table10 novembro 2024

Olliix by Martha Stewart Morocco/Gold Holls Console Table10 novembro 2024 -

Bíblia Sagrada Almeida Revista e Corrigida em áudio: Antigo e Novo Testamento (Audible Audio Edition): Sociedade Bíblica do Brasil, Edson Tauhyl, Sociedade Bíblica do Brasil: Audible Books & Originals10 novembro 2024

Bíblia Sagrada Almeida Revista e Corrigida em áudio: Antigo e Novo Testamento (Audible Audio Edition): Sociedade Bíblica do Brasil, Edson Tauhyl, Sociedade Bíblica do Brasil: Audible Books & Originals10 novembro 2024 -

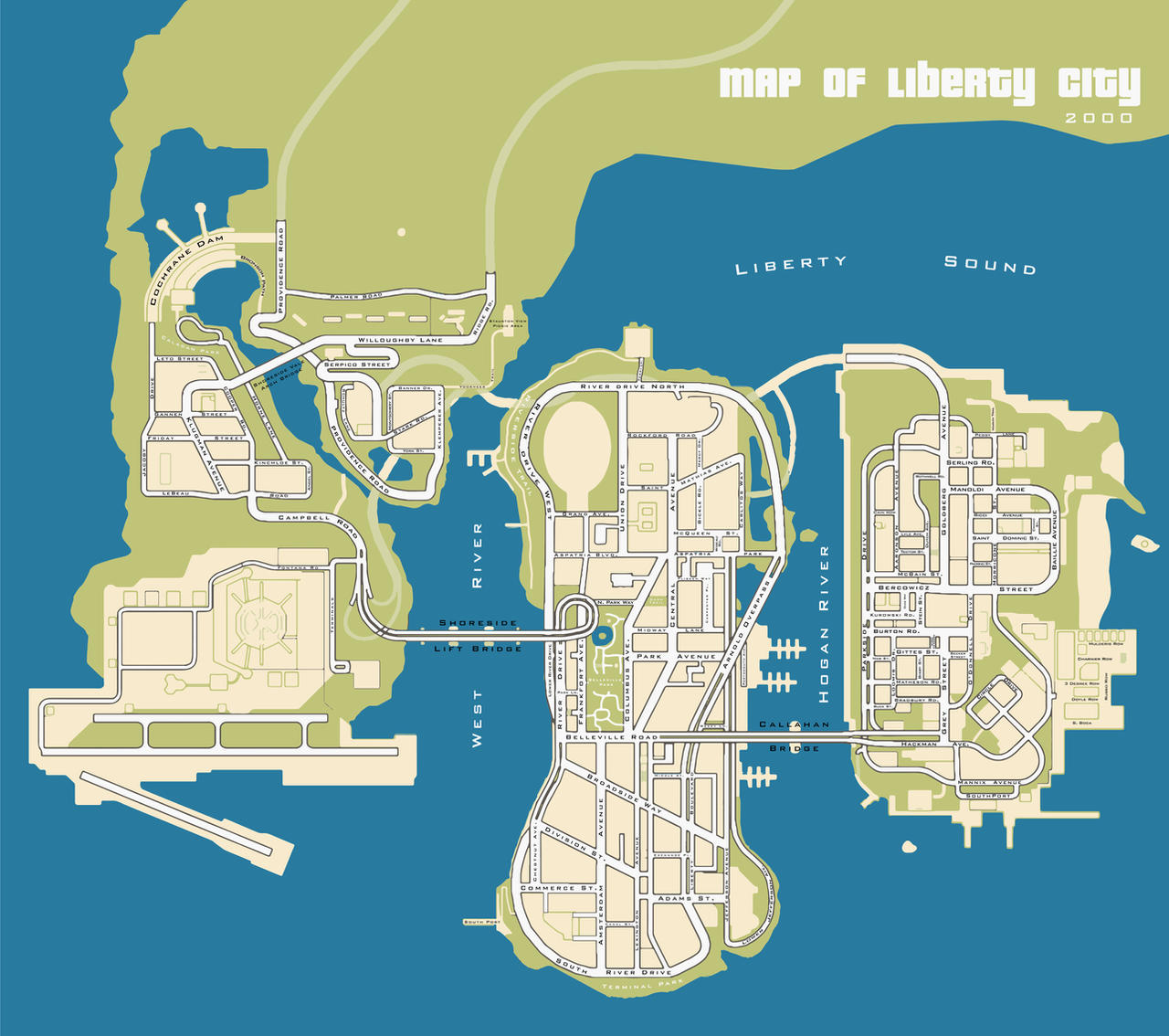

Map of Liberty City - with street names by roset03 on DeviantArt10 novembro 2024

Map of Liberty City - with street names by roset03 on DeviantArt10 novembro 2024 -

💬 Haftarah Reading for Parashat Ki Tissa (1 Kings 18:1-39): Chantable English translation with trōp, by Len Fellman • the Open Siddur Project ✍ פְּרוֺיֶּקט הַסִּדּוּר הַפָּתוּחַ10 novembro 2024

-

Subway Surfers World Tour: Veneza, Subway Surfers Wiki BR10 novembro 2024

Subway Surfers World Tour: Veneza, Subway Surfers Wiki BR10 novembro 2024