Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 08 novembro 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Students on an F1 Visa Don't Have to Pay FICA Taxes —

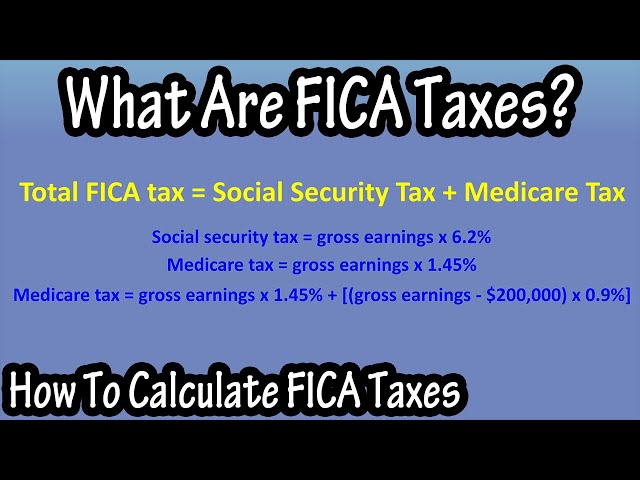

What Is And How To Calculate FICA Taxes Explained, Social Security

Historical Social Security and FICA Tax Rates for a Family of Four

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

The Basics on Payroll Tax

What Is FICA? Is It The Same As Social Security?

What is FICA and why does it matter for Social Security, Medicare

Understanding FICA (Social Security and Medicare) Taxes - MyIRSteam

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

FICA Tax Exemption for Nonresident Aliens Explained

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

2017 FICA Tax: What You Need to Know

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

The Social Security tax rate for employees is 6.2 percent, a

Recomendado para você

-

What is FICA08 novembro 2024

What is FICA08 novembro 2024 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays08 novembro 2024

Federal Insurance Contributions Act (FICA): What It Is, Who Pays08 novembro 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes08 novembro 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes08 novembro 2024 -

Social Security Administration - “What is FICA on my paycheck?” Find out08 novembro 2024

-

FICA Tax: Understanding Social Security and Medicare Taxes08 novembro 2024

-

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?08 novembro 2024

Why Is There a Cap on the FICA Tax?08 novembro 2024 -

What is the FICA Tax? - 2023 - Robinhood08 novembro 2024

-

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social08 novembro 2024

-

What Is FICA Tax?08 novembro 2024

What Is FICA Tax?08 novembro 2024 -

.jpg) What is FICA tax? Understanding FICA for small business08 novembro 2024

What is FICA tax? Understanding FICA for small business08 novembro 2024

você pode gostar

-

Mirai-Nikki-OVA-Large-04 - Lost in Anime08 novembro 2024

Mirai-Nikki-OVA-Large-04 - Lost in Anime08 novembro 2024 -

Stalker 2 is not being delayed and the release date is still 202308 novembro 2024

Stalker 2 is not being delayed and the release date is still 202308 novembro 2024 -

またね (Mata ne) (Romanized) – saya08 novembro 2024

またね (Mata ne) (Romanized) – saya08 novembro 2024 -

Triciclo Infantil Com Empurrador Motoca Passeio Vermelho08 novembro 2024

Triciclo Infantil Com Empurrador Motoca Passeio Vermelho08 novembro 2024 -

Câmera De Vídeo Aileho Kids Para Meninas Digital Câmera De Vídeo Para Crianças Aniversário Brinquedos 3 4 5 6 7 8 9 Anos Criança Câmera 8m 1080p Com - Carrefour08 novembro 2024

Câmera De Vídeo Aileho Kids Para Meninas Digital Câmera De Vídeo Para Crianças Aniversário Brinquedos 3 4 5 6 7 8 9 Anos Criança Câmera 8m 1080p Com - Carrefour08 novembro 2024 -

minx08 novembro 2024

minx08 novembro 2024 -

Switch 'N' Shoot08 novembro 2024

Switch 'N' Shoot08 novembro 2024 -

Haikyuu!! Season 3 Ending 01 - Mashi Mashi, Haikyuu!! Season 3 Ending 01 ♥ Song: Mashi Mashi by Nico Touches the Wall - Admin A-chan, By Nishinoya Yuu08 novembro 2024

-

Fenerbahçe Kulübü 115 yaşında - Son Dakika Haberleri08 novembro 2024

Fenerbahçe Kulübü 115 yaşında - Son Dakika Haberleri08 novembro 2024 -

Shingeki no Kyojin T4E20: Lembranças do Futuro08 novembro 2024

Shingeki no Kyojin T4E20: Lembranças do Futuro08 novembro 2024