Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 21 setembro 2024

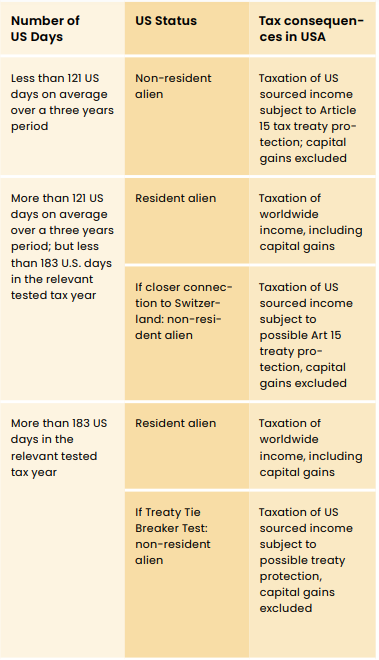

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Who Claims a Child on Taxes With 50/50 Custody? - SmartAsset

Global minimum tax? A rundown of the Pillar Two model rules

Dual residence and tax treaties' tie-breaker rules: Can a temporary accommodation amount to habitual abode?

Tie Breaker Rule in Tax Treaties

U.S. Australia Tax Treaty (Guidelines)

Expansion into the USA: dos and don'ts from a tax point of view - Lexology

Tax guide for American expats in the UK

Tax Treaties and Green Card Holders - Expat Tax Professionals

What is dual residence? Low Incomes Tax Reform Group

Taxpayer Wins Big In Federal Court—Tax Treaty Governs FBAR Reporting

MN Tax & Business Services

Relief Under Section 90/90a/91 of Income Tax Act, DTAA

A Guide to International Taxes when Working Remotely

A Guide to International Taxes when Working Remotely

Canada - U.S. Tie breaker rule - HTK Academy

Recomendado para você

-

TIE BREAKER black | Greeting Card21 setembro 2024

TIE BREAKER black | Greeting Card21 setembro 2024 -

Proper Course: Tie-Breaker21 setembro 2024

Proper Course: Tie-Breaker21 setembro 2024 -

Tie Breaker by Oakley®21 setembro 2024

Tie Breaker by Oakley®21 setembro 2024 -

Our Tie-breaker Baby21 setembro 2024

-

Break-Off Tools — Steel Dog21 setembro 2024

Break-Off Tools — Steel Dog21 setembro 2024 -

Tie Breaker, Bandipedia21 setembro 2024

-

PRINTABLE Personalized Tie Breaker Baby #3 Chalkboard Pregnancy Baby Announcement / Baby Number Three / Pink Teal / Sign / Photo Prop JPEG21 setembro 2024

PRINTABLE Personalized Tie Breaker Baby #3 Chalkboard Pregnancy Baby Announcement / Baby Number Three / Pink Teal / Sign / Photo Prop JPEG21 setembro 2024 -

Be the Referee: Cross Country Tie-Breaker21 setembro 2024

Be the Referee: Cross Country Tie-Breaker21 setembro 2024 -

Tie Breaker Prizm Grey Gradient Lenses, Polished Chrome Frame Sunglasses21 setembro 2024

Tie Breaker Prizm Grey Gradient Lenses, Polished Chrome Frame Sunglasses21 setembro 2024 -

150+ Tie Breaker Stock Illustrations, Royalty-Free Vector Graphics21 setembro 2024

150+ Tie Breaker Stock Illustrations, Royalty-Free Vector Graphics21 setembro 2024

você pode gostar

-

Verses of Praise - Renewing Worship21 setembro 2024

Verses of Praise - Renewing Worship21 setembro 2024 -

how to play amanda the adventurer theme sing in flute|TikTok Search21 setembro 2024

how to play amanda the adventurer theme sing in flute|TikTok Search21 setembro 2024 -

WORLD OF CONFUSION jogo online gratuito em21 setembro 2024

WORLD OF CONFUSION jogo online gratuito em21 setembro 2024 -

Talonflame, Wiki Pokédex21 setembro 2024

Talonflame, Wiki Pokédex21 setembro 2024 -

3D Kanojo: Real Girl Episode 4 - 6, Dude Really Needs To Get Out Of His Own Head21 setembro 2024

3D Kanojo: Real Girl Episode 4 - 6, Dude Really Needs To Get Out Of His Own Head21 setembro 2024 -

jejeloiu Cortinas de Valance de Beisebol para Sala de Estar Quarto, Cortinas de Cozinha com Tema Esportivo Sanefas, 3D Fogo Bola de Água Jogos Cortina Sanefas para Janelas Banheiro, 1 Painel 5221 setembro 2024

jejeloiu Cortinas de Valance de Beisebol para Sala de Estar Quarto, Cortinas de Cozinha com Tema Esportivo Sanefas, 3D Fogo Bola de Água Jogos Cortina Sanefas para Janelas Banheiro, 1 Painel 5221 setembro 2024 -

The Complexity of Lion Roars - Lion Recovery Fund21 setembro 2024

The Complexity of Lion Roars - Lion Recovery Fund21 setembro 2024 -

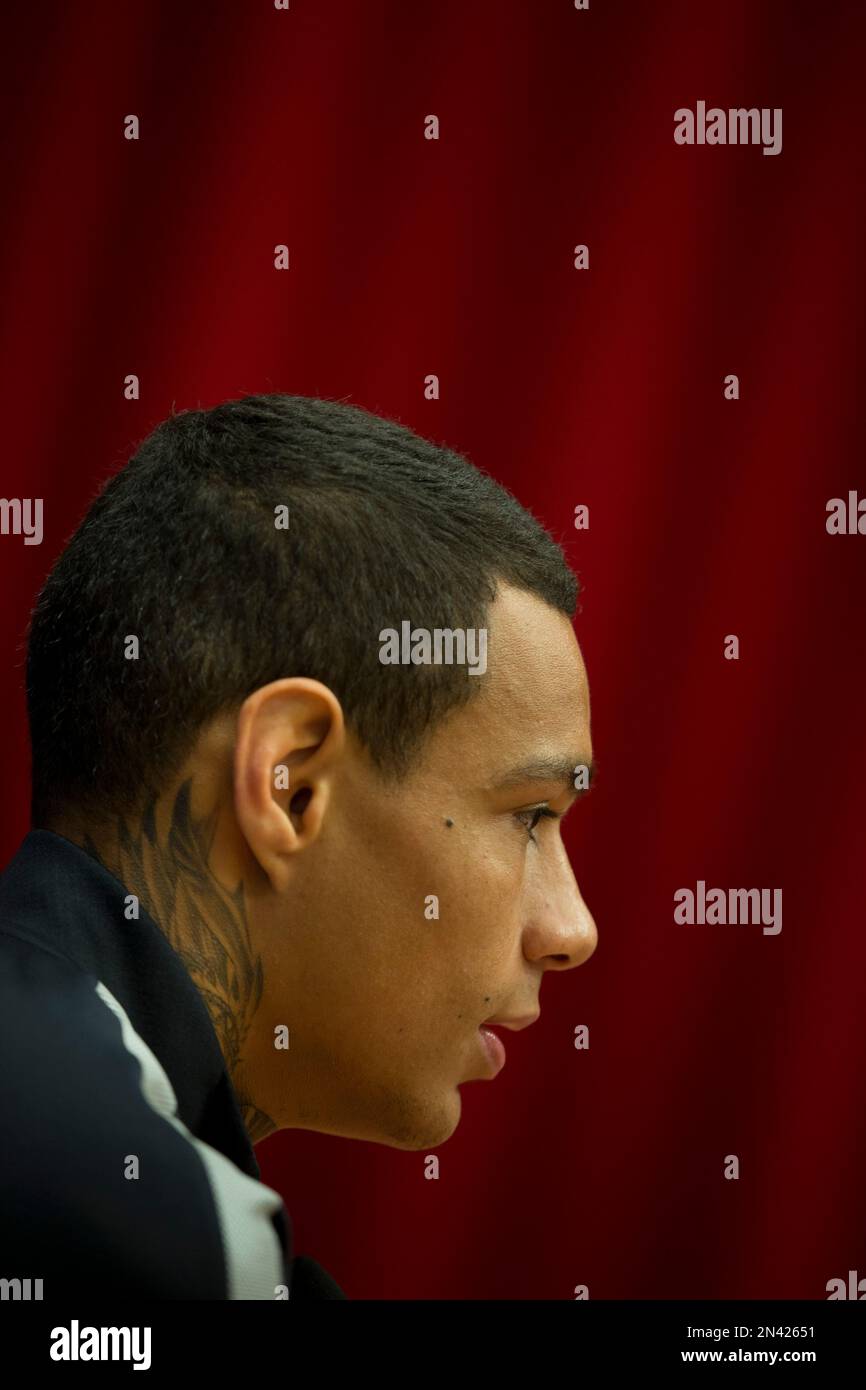

PSG's Gregory van der Wiel sports a tattoo in his neck as he21 setembro 2024

PSG's Gregory van der Wiel sports a tattoo in his neck as he21 setembro 2024 -

Stencil para Pintura 32 x 42cm - OPA2304 - Infantil Boneca - OPA21 setembro 2024

Stencil para Pintura 32 x 42cm - OPA2304 - Infantil Boneca - OPA21 setembro 2024 -

Atrioc on X: @qtcinderella @PointCrow Starting to think you might just be a bad teacher / X21 setembro 2024

Atrioc on X: @qtcinderella @PointCrow Starting to think you might just be a bad teacher / X21 setembro 2024