Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 01 janeiro 2025

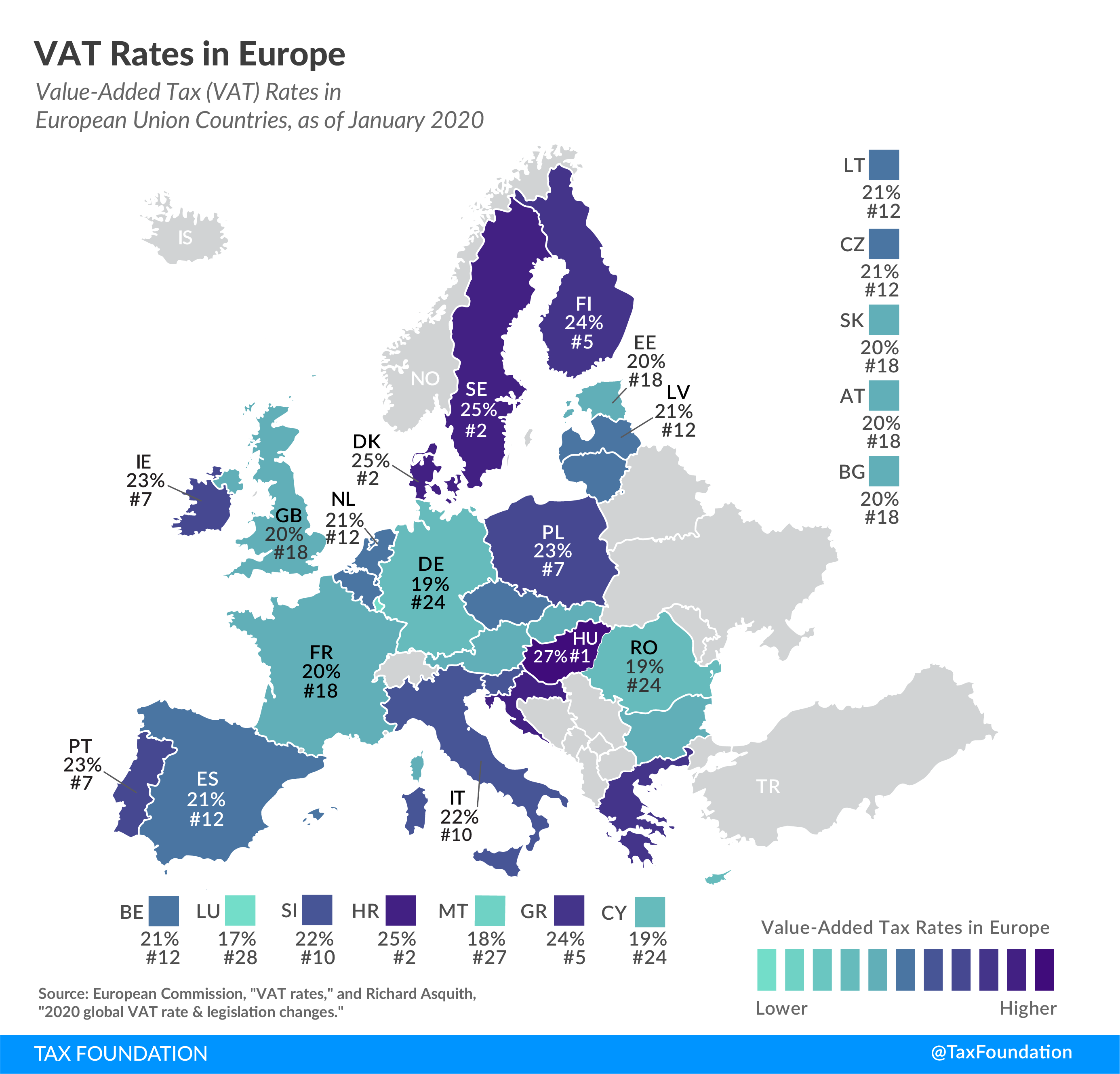

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK

The effect of tax cuts on economic growth and revenue - Economics Help

Full article: The Effects of the Value-Added Tax on Revenue and Inequality

Indirect taxes

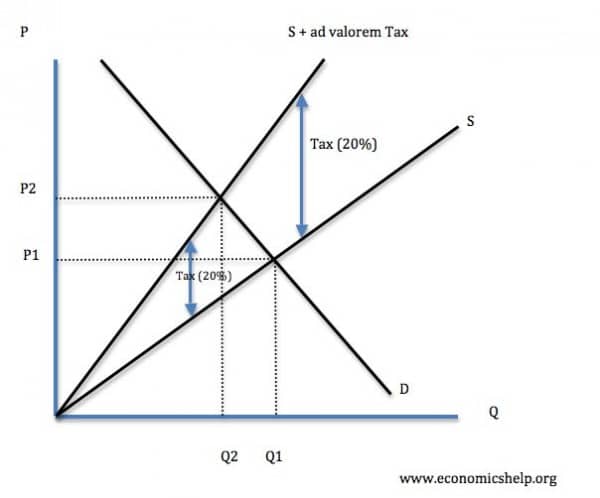

Ad valorem tax - Economics Help

Value Added Tax (VAT) Definition, TaxEDU

Value-added tax - Wikipedia

Value Added Tax (VAT) - Overview, How To Calculate, Example

:max_bytes(150000):strip_icc()/consumption-tax.asp_FINAL-96e3b673009d46b8b71253303e0efa38.png)

Consumption Tax: Definition, Types, vs. Income Tax

VAT reliefs for disabled and older people

Isabelle Sophie Monnier on LinkedIn: A very interesting report from Oxford Economics that explains in details…

Full article: The Effects of the Value-Added Tax on Revenue and Inequality

Recomendado para você

-

Completes Acquisition of Motors.co.uk01 janeiro 2025

Completes Acquisition of Motors.co.uk01 janeiro 2025 -

launches UK 'Your Shopping Universe' campaign - Inc.01 janeiro 2025

launches UK 'Your Shopping Universe' campaign - Inc.01 janeiro 2025 -

UK : For Charity01 janeiro 2025

UK : For Charity01 janeiro 2025 -

Advice from an Consultant, Seller and Account Manager01 janeiro 2025

Advice from an Consultant, Seller and Account Manager01 janeiro 2025 -

.co.uk01 janeiro 2025

-

.co.uk (couk) - Profile01 janeiro 2025

.co.uk (couk) - Profile01 janeiro 2025 -

for business –01 janeiro 2025

for business –01 janeiro 2025 -

Dropshipping UK, Complete Updated Guide01 janeiro 2025

Dropshipping UK, Complete Updated Guide01 janeiro 2025 -

Authenticity Guarantee UK01 janeiro 2025

Authenticity Guarantee UK01 janeiro 2025 -

Lokal shopping launched in Germany - ChannelX01 janeiro 2025

Lokal shopping launched in Germany - ChannelX01 janeiro 2025

você pode gostar

-

JoJolion Vol. 21 100% OFF - Tokyo Otaku Mode (TOM)01 janeiro 2025

JoJolion Vol. 21 100% OFF - Tokyo Otaku Mode (TOM)01 janeiro 2025 -

Top 10 The Beatles Songs 🔥 Let us know if you disagree @The Beatles #, here comes the sun01 janeiro 2025

-

SOLUTION: THE LIFE AND GAMES OF MIKHAIL TAL CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS - Studypool01 janeiro 2025

SOLUTION: THE LIFE AND GAMES OF MIKHAIL TAL CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS CHESS - Studypool01 janeiro 2025 -

Kurtis Stryker, Mortal Kombat Wiki, FANDOM powered by Wikia01 janeiro 2025

Kurtis Stryker, Mortal Kombat Wiki, FANDOM powered by Wikia01 janeiro 2025 -

Mahjong Titans Screenshot Mahjong, Games, Board game online01 janeiro 2025

Mahjong Titans Screenshot Mahjong, Games, Board game online01 janeiro 2025 -

𝐓𝐚𝐢𝐤𝐨睡眠 - 🍜: Fuufu Ijou, Koibito Miman. 🎥: Chapter 6601 janeiro 2025

-

Shuumatsu no Harem ganhará anime! – Tomodachi Nerd's01 janeiro 2025

Shuumatsu no Harem ganhará anime! – Tomodachi Nerd's01 janeiro 2025 -

CHINELO PET FOFINHOS COLCCI - Fofura Baby Kids - Qualidade e01 janeiro 2025

CHINELO PET FOFINHOS COLCCI - Fofura Baby Kids - Qualidade e01 janeiro 2025 -

Ideias para casais - Jogo divertido e dinâmico, para o casal01 janeiro 2025

-

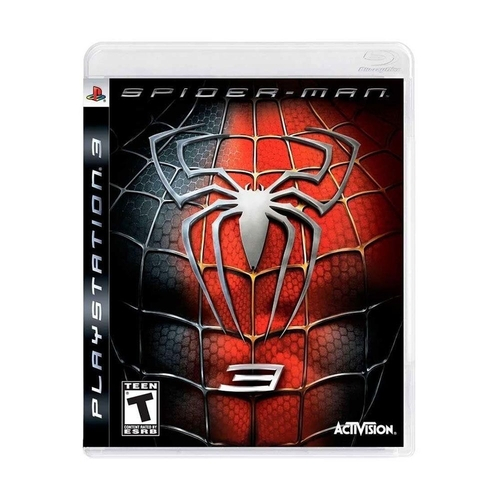

Spider Man 3 PS3 na Americanas Empresas01 janeiro 2025

Spider Man 3 PS3 na Americanas Empresas01 janeiro 2025