Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 10 novembro 2024

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

GST Council Meet Pushed To Sept Amid Delay In GoM's Report On

Storyboard18 GST of 28% on online gaming would put survival of

Online Real Money Gaming Gets Equated with Gambling In Taxation

India: 28% tax on casinos, online gaming likely to go into effect

Implementation of 28% GST rate will bring challenges to online

gst: Online gaming industry okay with 28% GST on gross gaming

28% GST will prove to be catastrophic for the gaming industry, say

India's $3-billion Online Gaming Industry is Battling the Odds

28% GST on ONLINE GAMING – Revenue generating tool or Will it lead

Recomendado para você

-

![Best Cloud Gaming Services of 2023 [Shadow PC & Alternatives]](https://www.cloudwards.net/wp-content/uploads/2020/09/best-cloud-gaming-services.png) Best Cloud Gaming Services of 2023 [Shadow PC & Alternatives]10 novembro 2024

Best Cloud Gaming Services of 2023 [Shadow PC & Alternatives]10 novembro 2024 -

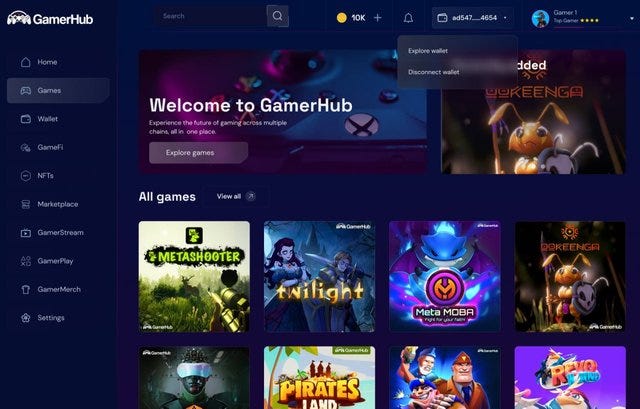

Gamer Hub. Gamer Hub is a revolutionary online…, by Fikayoh10 novembro 2024

Gamer Hub. Gamer Hub is a revolutionary online…, by Fikayoh10 novembro 2024 -

Why html5: The future of global online mobile gaming business10 novembro 2024

Why html5: The future of global online mobile gaming business10 novembro 2024 -

Stake - Online Casino Gaming Platform, Laravel Single Page Application10 novembro 2024

Stake - Online Casino Gaming Platform, Laravel Single Page Application10 novembro 2024 -

How gaming platforms have become the new social media10 novembro 2024

How gaming platforms have become the new social media10 novembro 2024 -

Online gaming platform, casino and gambling business. Cards, dice and multi-colored game pieces on laptop keyboard. Sports & Recreation Stock Photos10 novembro 2024

Online gaming platform, casino and gambling business. Cards, dice and multi-colored game pieces on laptop keyboard. Sports & Recreation Stock Photos10 novembro 2024 -

How to Choose the Best Online Casino Gaming Platform - The Street Journal10 novembro 2024

How to Choose the Best Online Casino Gaming Platform - The Street Journal10 novembro 2024 -

The best game-streaming services for 202210 novembro 2024

The best game-streaming services for 202210 novembro 2024 -

What are the legal guidelines for starting an online gaming platform? by Finlaw Consultancy - Issuu10 novembro 2024

What are the legal guidelines for starting an online gaming platform? by Finlaw Consultancy - Issuu10 novembro 2024 -

How to win real money online? 5 best gaming sites 2022 - The10 novembro 2024

How to win real money online? 5 best gaming sites 2022 - The10 novembro 2024

você pode gostar

-

manga and anime : r/Berserk10 novembro 2024

manga and anime : r/Berserk10 novembro 2024 -

Steam Community :: Guide :: FPS Boost10 novembro 2024

-

Steam Workshop::Project SCRAMBLE10 novembro 2024

Steam Workshop::Project SCRAMBLE10 novembro 2024 -

Como a tecnologia do PS5 deu vida ao jogo A Plague Tale: Requiem – PlayStation.Blog BR10 novembro 2024

Como a tecnologia do PS5 deu vida ao jogo A Plague Tale: Requiem – PlayStation.Blog BR10 novembro 2024 -

Controle Sem Fio Dualsense Midnight Black Playstation®5 + Game10 novembro 2024

Controle Sem Fio Dualsense Midnight Black Playstation®5 + Game10 novembro 2024 -

Quando a piada perde a graça e vira ofensa – Jornal do Campus10 novembro 2024

Quando a piada perde a graça e vira ofensa – Jornal do Campus10 novembro 2024 -

Boat Stealth addon - Mirror's Edge - Mod DB10 novembro 2024

Boat Stealth addon - Mirror's Edge - Mod DB10 novembro 2024 -

SONY DualSense Edge Wireless Controller (CFI-ZCP1J) – WAFUU JAPAN10 novembro 2024

SONY DualSense Edge Wireless Controller (CFI-ZCP1J) – WAFUU JAPAN10 novembro 2024 -

Topic - Funtime Foxy X lolbit10 novembro 2024

Topic - Funtime Foxy X lolbit10 novembro 2024 -

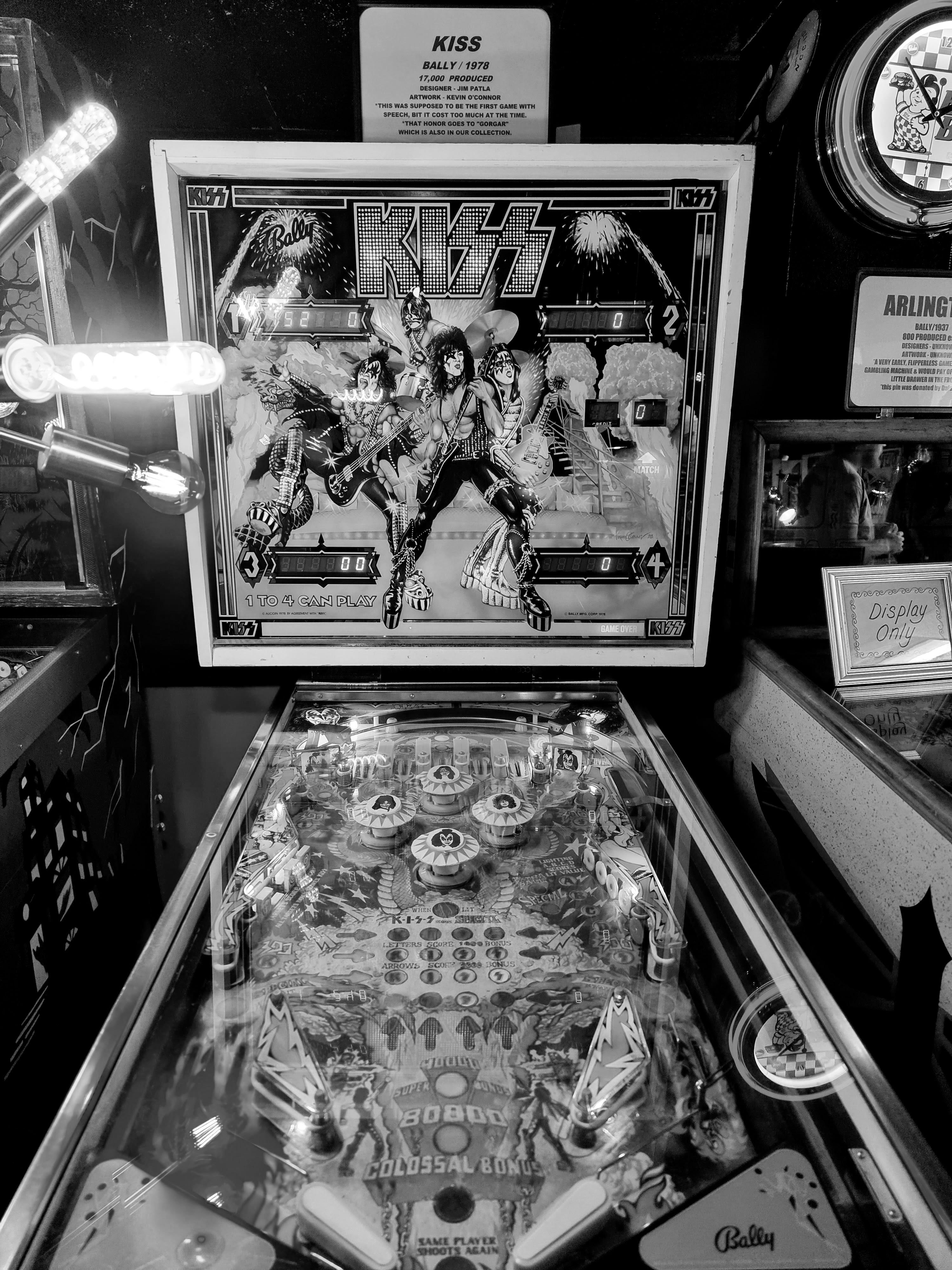

Issue 1: Designing a Pinball Machine - by Marenco Kemp10 novembro 2024

Issue 1: Designing a Pinball Machine - by Marenco Kemp10 novembro 2024