Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Last updated 22 dezembro 2024

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

Nonresident Aliens and Social Security - GW Carter Ltd

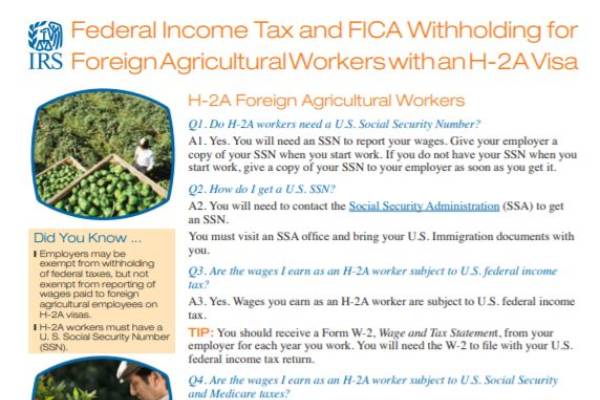

Income Taxes and FICA Withholding Exemption(s) for Foreign Workers

The Complete J1 Student Guide to Tax in the US

Taxes for Mexicans Working in US, TFX

Which Employees Are Exempt From Tax Withholding?

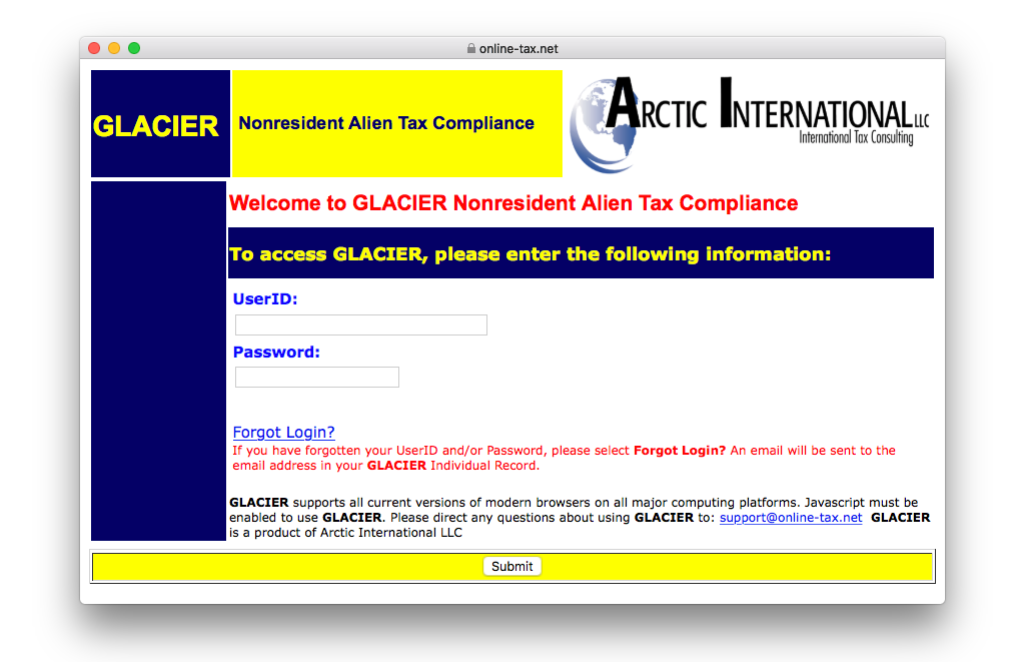

Nonresident Alien, Financial Affairs, UTSA

Federal Income Tax and FICA Withholding for Foreign Agricultural

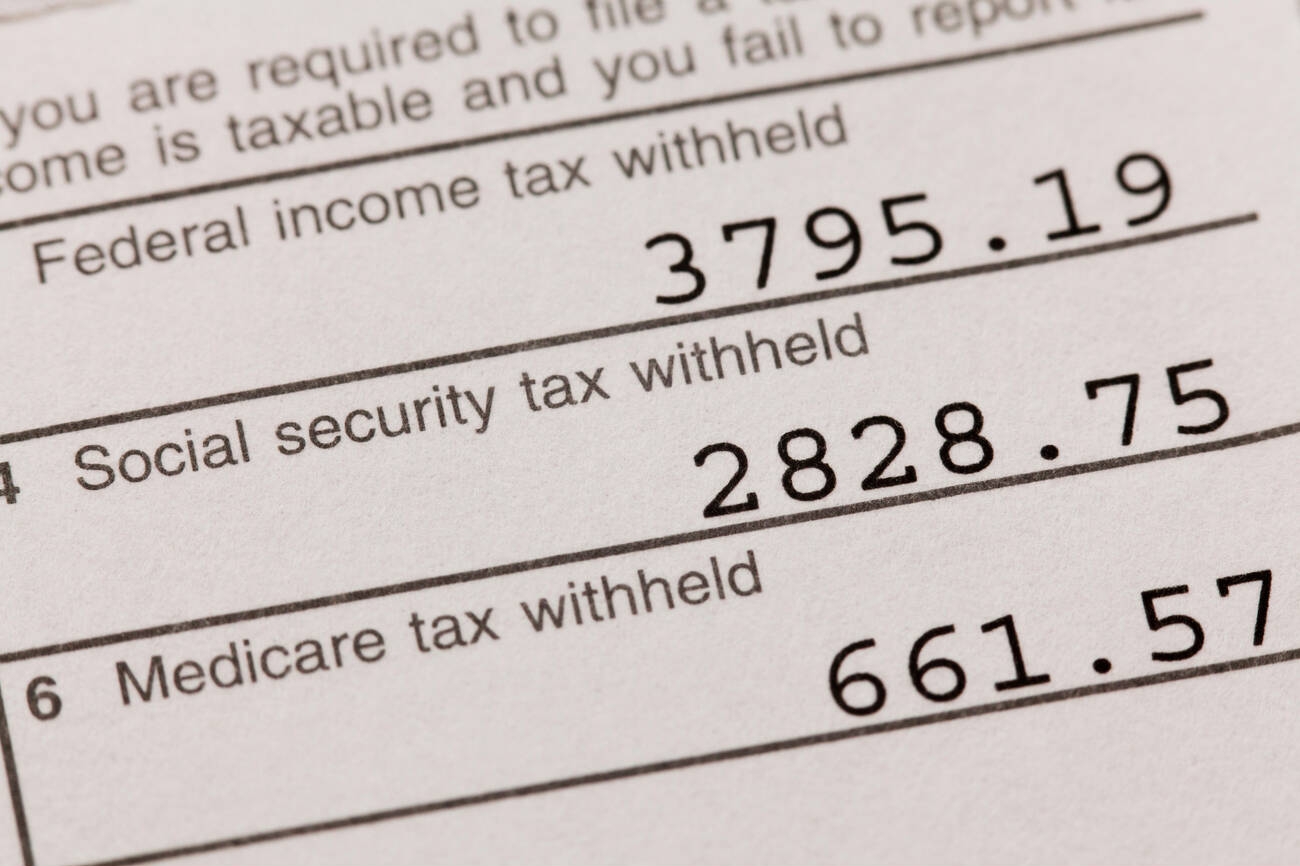

What are FICA Taxes? Social Security & Medicare Taxes Explained

Publication 915 (2022), Social Security and Equivalent Railroad

Glacier Nonresident Alien Tax Compliance System - Payroll

2023 FICA Tax Limits and Rates (How it Affects You)

Social Security Tax Wage Base is Going Up 5.2% for 2024 - CPA

Recomendado para você

-

What is FICA tax?22 dezembro 2024

What is FICA tax?22 dezembro 2024 -

What is the FICA Tax and How Does It Work? - Ramsey22 dezembro 2024

What is the FICA Tax and How Does It Work? - Ramsey22 dezembro 2024 -

What Is the FICA Tax and Why Does It Exist? - TheStreet22 dezembro 2024

What Is the FICA Tax and Why Does It Exist? - TheStreet22 dezembro 2024 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers22 dezembro 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers22 dezembro 2024 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime22 dezembro 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime22 dezembro 2024 -

What is the FICA Tax Refund? - Boundless22 dezembro 2024

What is the FICA Tax Refund? - Boundless22 dezembro 2024 -

FICA explained: Social Security and Medicare tax rates to know in 202322 dezembro 2024

FICA explained: Social Security and Medicare tax rates to know in 202322 dezembro 2024 -

What Eliminating FICA Tax Means for Your Retirement22 dezembro 2024

-

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.22 dezembro 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.22 dezembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com22 dezembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com22 dezembro 2024

você pode gostar

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/22962905/EwOMTgn.png) Sony now uses PlayStation PC label for its PC games - The Verge22 dezembro 2024

Sony now uses PlayStation PC label for its PC games - The Verge22 dezembro 2024 -

Shadow Mewtwo & Lugia Tag Team GX Custom Made22 dezembro 2024

Shadow Mewtwo & Lugia Tag Team GX Custom Made22 dezembro 2024 -

Doi-kun tampan😎☝️ nonton shuumatsu new eps, check profile22 dezembro 2024

-

Download do APK de Jogos de Carros para Android22 dezembro 2024

Download do APK de Jogos de Carros para Android22 dezembro 2024 -

Yo, señor, no soy malo, aunque - Real Academia Española22 dezembro 2024

-

Gears of War 3 Forces of Nature DLC announced22 dezembro 2024

Gears of War 3 Forces of Nature DLC announced22 dezembro 2024 -

![10 Best PC Game Graphics To Push Your PC TO THE LIMIT [4K Video]](https://i.ytimg.com/vi/Zfsg3oiPXGc/maxresdefault.jpg) 10 Best PC Game Graphics To Push Your PC TO THE LIMIT [4K Video]22 dezembro 2024

10 Best PC Game Graphics To Push Your PC TO THE LIMIT [4K Video]22 dezembro 2024 -

Poppy Playtime Chapter 1 para Android - Download22 dezembro 2024

Poppy Playtime Chapter 1 para Android - Download22 dezembro 2024 -

Five Nights at Toy Freddy's Series : RickyG : Free Download22 dezembro 2024

Five Nights at Toy Freddy's Series : RickyG : Free Download22 dezembro 2024 -

What are the top 5 anime that have many fans all over the world22 dezembro 2024