Cash App Taxes 2023 (Tax Year 2022) Review

Por um escritor misterioso

Last updated 08 novembro 2024

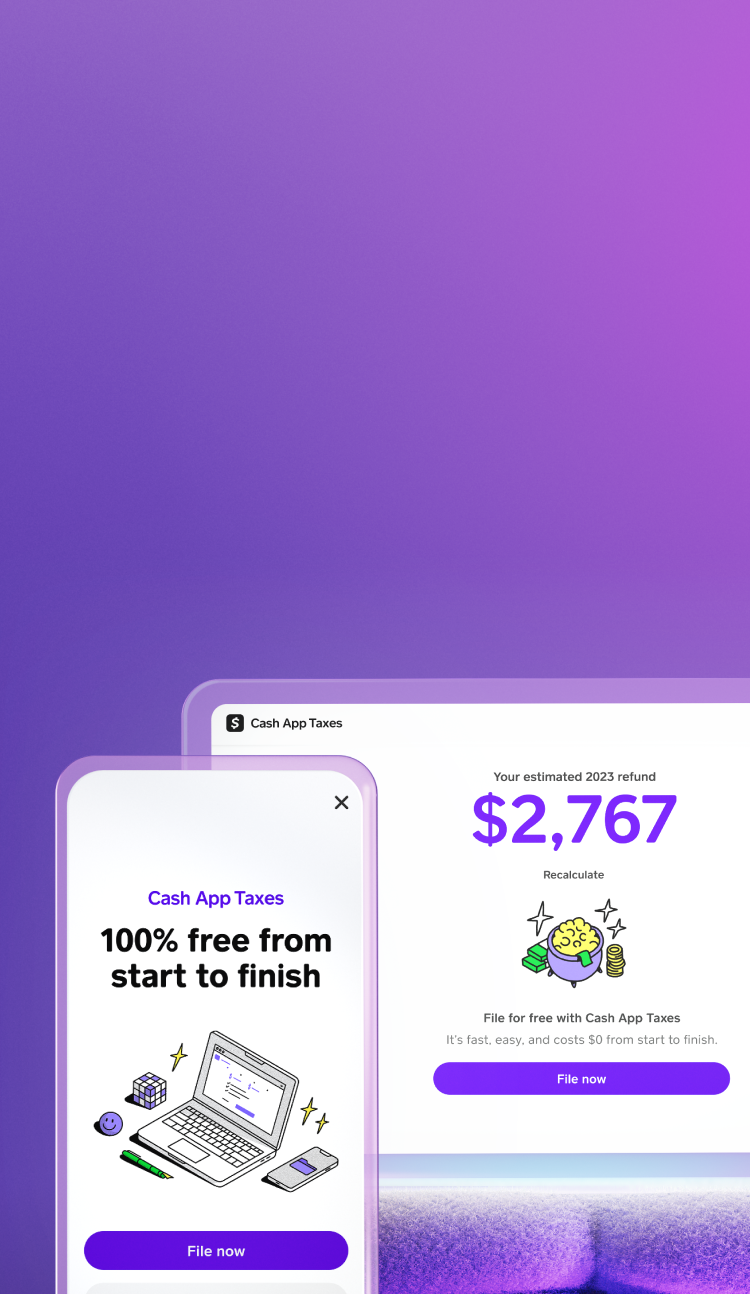

Cash App Taxes supports most IRS forms and schedules for federal and state returns, including Schedule C. It's the only service we've tested that doesn't cost a dime for preparation and filing, but it doesn't offer as much support as paid apps.

Free, comprehensive federal and state tax filing

Free, comprehensive federal and state tax filing

What is Cash App & How Does It Work?

How to Deduct Your Cell Phone Bill on Your Taxes

Best Tax Software Of December 2023 – Forbes Advisor

The IRS Delays Reporting Changes For Venmo, CashApp And Other Payment Apps – Forbes Advisor

TaxAct Review 2023: Pricing, Pros & Cons, Who Should Use It

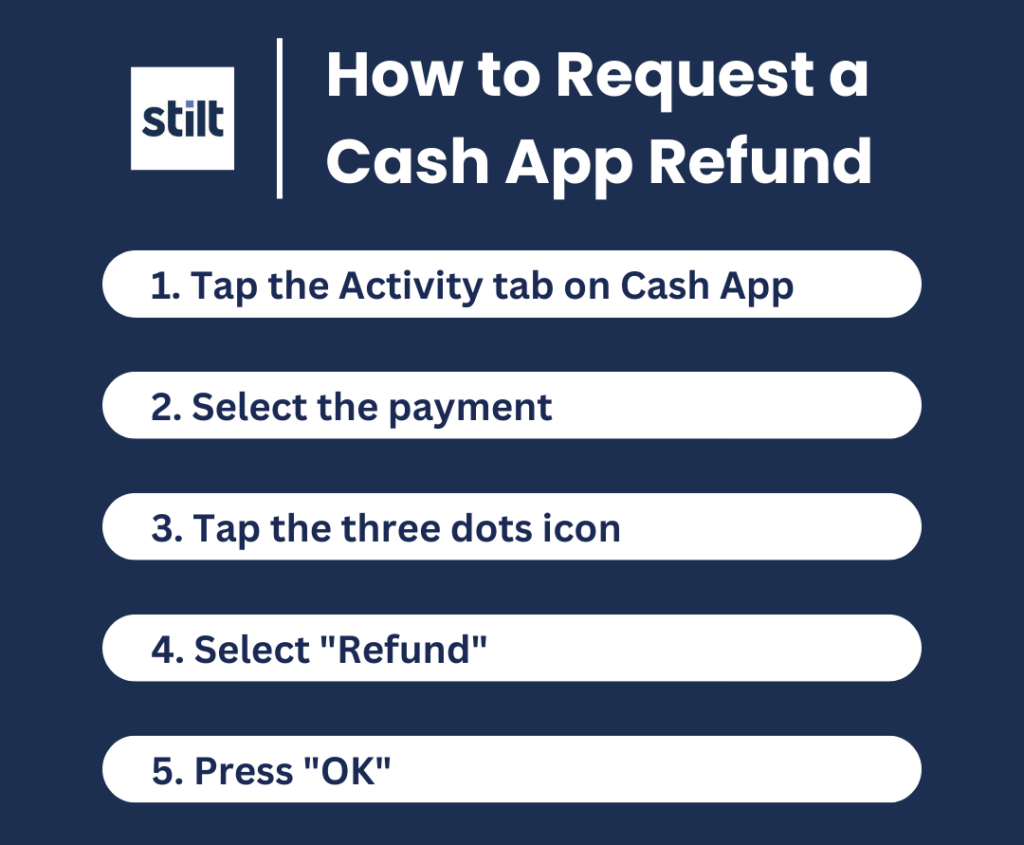

THIS is how to easily get a Cash App refund [2023]

Cash App Taxes Review: How It Works & Is It Worth It?

Cash App Income is Taxable; IRS Changes Rules in 2022

Free Tax Filing - Cash App Taxes

Cash App Taxes Review: Free Straightforward Preparation Service

Best Tax Software Of December 2023 – Forbes Advisor

When Are Taxes Due in 2022? – Forbes Advisor

Recomendado para você

-

Robux 1 000x - Game Items - Gameflip08 novembro 2024

-

Group gamepass got DIFFERENT price depending on uploader? - Website Bugs - Developer Forum08 novembro 2024

Group gamepass got DIFFERENT price depending on uploader? - Website Bugs - Developer Forum08 novembro 2024 -

90% Marketplace Fee on Group Places - #22 by HilyrHere - Game Design Support - Developer Forum08 novembro 2024

90% Marketplace Fee on Group Places - #22 by HilyrHere - Game Design Support - Developer Forum08 novembro 2024 -

Tax Avoidance Gamepass - Roblox08 novembro 2024

-

Gamepass tax - Roblox08 novembro 2024

-

Roblox 10k R$ 10000 robux gamepass method 5 days pending type (tax covered)08 novembro 2024

Roblox 10k R$ 10000 robux gamepass method 5 days pending type (tax covered)08 novembro 2024 -

What is the reason for Roblox's 30% flat tax on profits? : r/roblox08 novembro 2024

What is the reason for Roblox's 30% flat tax on profits? : r/roblox08 novembro 2024 -

oxygen💉 on X: Do any Roblox artists have commissions open? Make sure to drop your prices! Gamepass/t-shirt only, you must include tax to your price so I know exactly how much I'm08 novembro 2024

oxygen💉 on X: Do any Roblox artists have commissions open? Make sure to drop your prices! Gamepass/t-shirt only, you must include tax to your price so I know exactly how much I'm08 novembro 2024 -

Going second, 50k bbc for 50 robux + tax with SnooHabits9886 : u/WilmaTheUnicorn08 novembro 2024

Going second, 50k bbc for 50 robux + tax with SnooHabits9886 : u/WilmaTheUnicorn08 novembro 2024 -

tax money - Roblox08 novembro 2024

você pode gostar

-

44th Chess Olympiad: Swedish player lauds Indian chess culture, players08 novembro 2024

44th Chess Olympiad: Swedish player lauds Indian chess culture, players08 novembro 2024 -

PlayStation, Square Enix “Parasite Eve 3” Or “The 3rd Birthday” Video Game Trailer. Parasites & Hot Girls. – LOYAL K.N.G.08 novembro 2024

PlayStation, Square Enix “Parasite Eve 3” Or “The 3rd Birthday” Video Game Trailer. Parasites & Hot Girls. – LOYAL K.N.G.08 novembro 2024 -

Production I.G - Wikipedia08 novembro 2024

Production I.G - Wikipedia08 novembro 2024 -

Horimiya 2 - Abacus Online08 novembro 2024

Horimiya 2 - Abacus Online08 novembro 2024 -

osu! (2007)08 novembro 2024

osu! (2007)08 novembro 2024 -

How to Get Sea of Thieves Free with Xbox Game Pass Trial08 novembro 2024

How to Get Sea of Thieves Free with Xbox Game Pass Trial08 novembro 2024 -

Rede Social Educativa Epedagogia - Área para criar jogos08 novembro 2024

Rede Social Educativa Epedagogia - Área para criar jogos08 novembro 2024 -

John Pork Is Calling T Shirt 2023 Trend Fans Graphic Tee Tops O-neck 100% Cotton Unisex Casual Soft T-shirt EU Size - AliExpress08 novembro 2024

John Pork Is Calling T Shirt 2023 Trend Fans Graphic Tee Tops O-neck 100% Cotton Unisex Casual Soft T-shirt EU Size - AliExpress08 novembro 2024 -

total drama island 2023 intro song|TikTok Search08 novembro 2024

total drama island 2023 intro song|TikTok Search08 novembro 2024 -

Compass Leaning Against Chess Piece With Other Chess Pieces In08 novembro 2024

Compass Leaning Against Chess Piece With Other Chess Pieces In08 novembro 2024