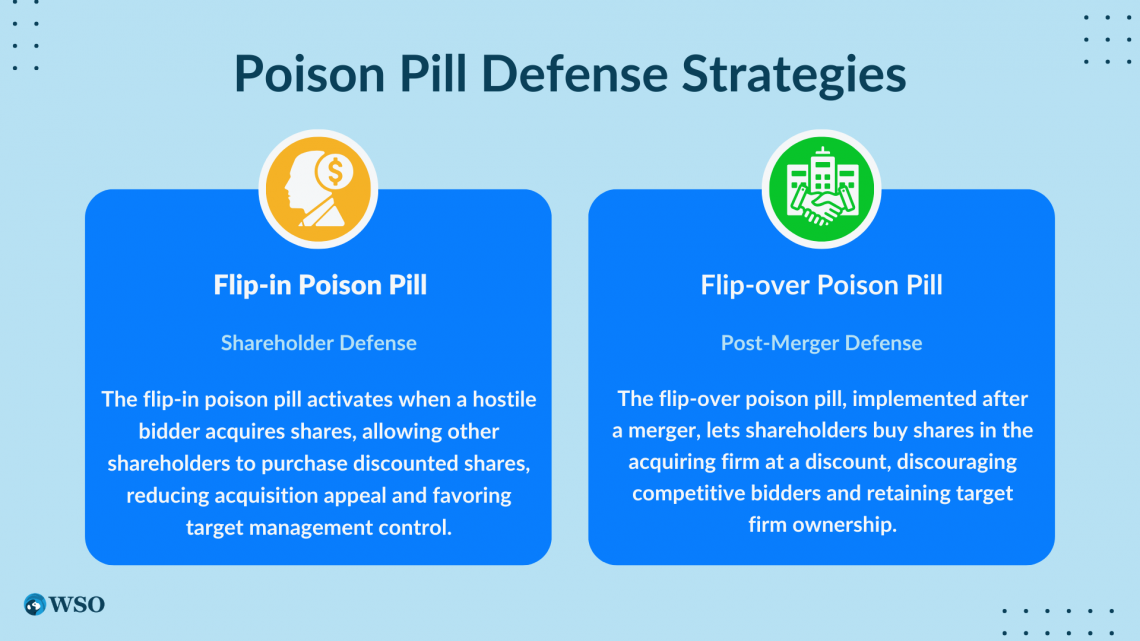

Poison Pill: A Defense Strategy and Shareholder Rights Plan

Por um escritor misterioso

Last updated 23 dezembro 2024

:max_bytes(150000):strip_icc()/poisonpill-Final-23f0fee2b8264451a9fb1a499e92b5e2.png)

The poison pill is a tactic public companies sometimes use to deter a hostile takeover.

Pre-Offer Defense Mechanism - Overview, Objectives, Types

Poison Pill (Mergers and Acquisitions)

1. Values from M&A 2. The practice 1. Takeover effects 2. Anti-takeover devises 3. Other concepts 3. Valuation methods Mergers & Acquisitions 1 L8: M&A. - ppt download

Will Twitter's 'poison pill' strategy stop Elon Musk's hostile takeover?

Poison Pill Defense M&A Definition + Examples

:max_bytes(150000):strip_icc()/Hostile-Takeover-Final-18284f0c8dca4b4696feca038afcb61f.jpg)

Poison Pill: A Defense Strategy and Shareholder Rights Plan

Twitter outlines the ingredients of its poison pill - Protocol

Unveiling the Poison Pill: A Defensive Tactic in Hostile Takeovers - FasterCapital

What is a poison pill in business? Twitter responds to Elon Musk

Flip-Over Strategy: a poison pill strategy for companies to protect themselves from a hostile takeover., The Global Pool Consulting Pty Ltd posted on the topic

As Share Prices Drop, Retailers Are on the Defensive With Poison Pills – Sourcing Journal

Recomendado para você

-

Papa's Wingeria To Go!, Flipline Studios Wiki23 dezembro 2024

Papa's Wingeria To Go!, Flipline Studios Wiki23 dezembro 2024 -

Discuss Everything About Flipline Studios Wiki23 dezembro 2024

Discuss Everything About Flipline Studios Wiki23 dezembro 2024 -

Papa's Wingeria HD, Flipline Studios Wiki23 dezembro 2024

Papa's Wingeria HD, Flipline Studios Wiki23 dezembro 2024 -

Pizza - Simple English Wikipedia, the free encyclopedia23 dezembro 2024

Pizza - Simple English Wikipedia, the free encyclopedia23 dezembro 2024 -

Mary, Flipline Studios Wiki23 dezembro 2024

Mary, Flipline Studios Wiki23 dezembro 2024 -

Chuck, Flipline Studios Wiki23 dezembro 2024

Chuck, Flipline Studios Wiki23 dezembro 2024 -

Pizza Hut - Wikipedia23 dezembro 2024

Pizza Hut - Wikipedia23 dezembro 2024 -

Papa's Pizzeria To Go! on the App Store23 dezembro 2024

Papa's Pizzeria To Go! on the App Store23 dezembro 2024 -

Chipotle Mexican Grill - Wikiwand23 dezembro 2024

Chipotle Mexican Grill - Wikiwand23 dezembro 2024 -

Angilo's Pizza and Hoagies23 dezembro 2024

Angilo's Pizza and Hoagies23 dezembro 2024

você pode gostar

-

ALL ROBLOX TOWER DEFENCE SIMULATOR CODES! Roblox Tower Defence Simulator23 dezembro 2024

ALL ROBLOX TOWER DEFENCE SIMULATOR CODES! Roblox Tower Defence Simulator23 dezembro 2024 -

Peaches And Herb' 'Reunited' On TV One's 'Unsung23 dezembro 2024

Peaches And Herb' 'Reunited' On TV One's 'Unsung23 dezembro 2024 -

Todo dia um desenho que ninguém lembra o nome - e o nome daquele23 dezembro 2024

-

ArtStation - King Of The Hill Game Concept (2021)23 dezembro 2024

ArtStation - King Of The Hill Game Concept (2021)23 dezembro 2024 -

PS5 VS XBOX Series SX: Controllers CrossPlay Leak Confirmed23 dezembro 2024

PS5 VS XBOX Series SX: Controllers CrossPlay Leak Confirmed23 dezembro 2024 -

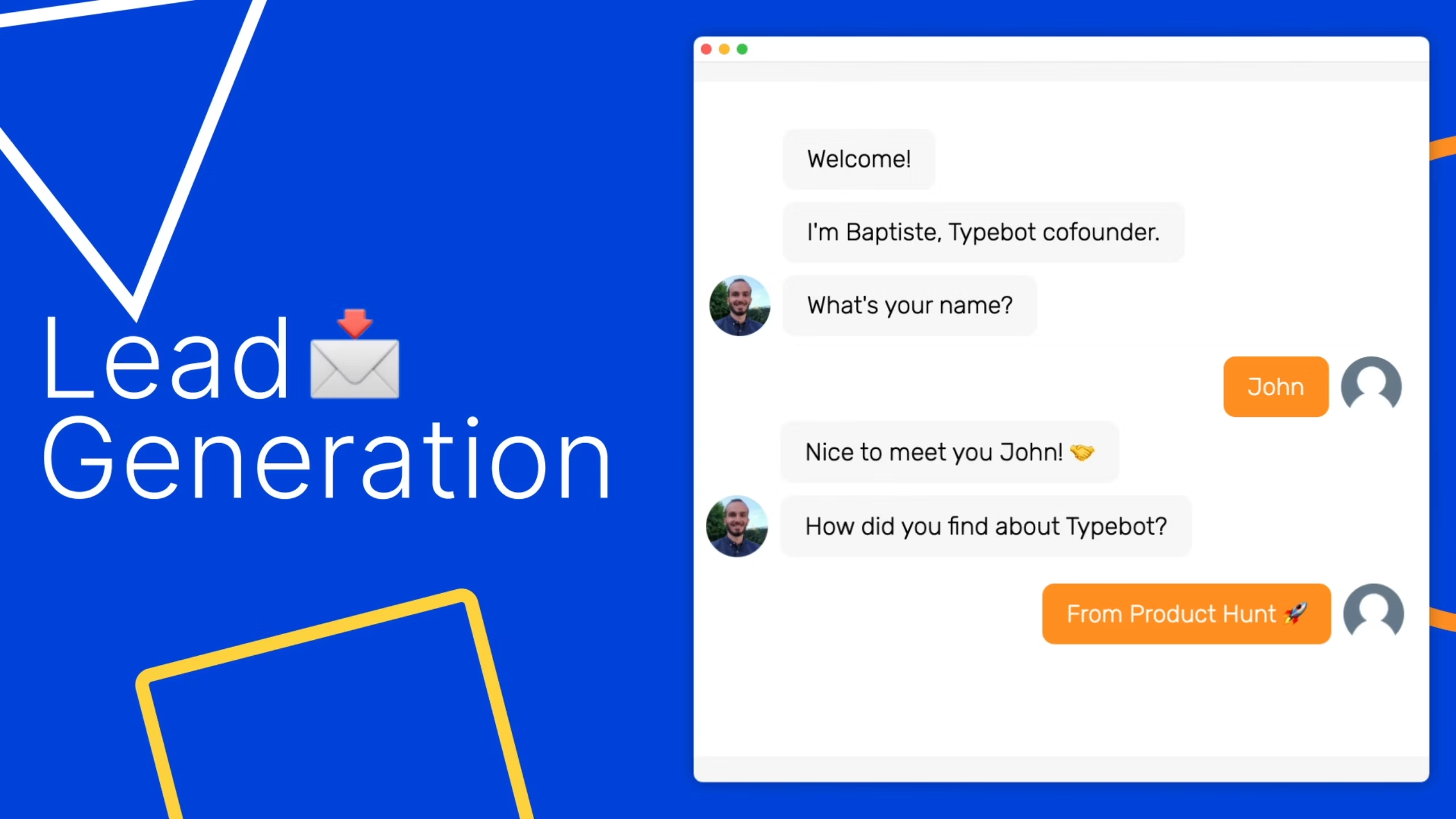

Typebot - Product Information, Latest Updates, and Reviews 202323 dezembro 2024

Typebot - Product Information, Latest Updates, and Reviews 202323 dezembro 2024 -

2048.io APK Download 2023 - Free - 9Apps23 dezembro 2024

2048.io APK Download 2023 - Free - 9Apps23 dezembro 2024 -

Sono Bisque Doll ganha novo visual para promover evento importante23 dezembro 2024

Sono Bisque Doll ganha novo visual para promover evento importante23 dezembro 2024 -

ArkDragons23 dezembro 2024

-

Steel Dog Tie Breaker23 dezembro 2024

Steel Dog Tie Breaker23 dezembro 2024