2017 Tax Law Is Fundamentally Flawed

Por um escritor misterioso

Last updated 22 dezembro 2024

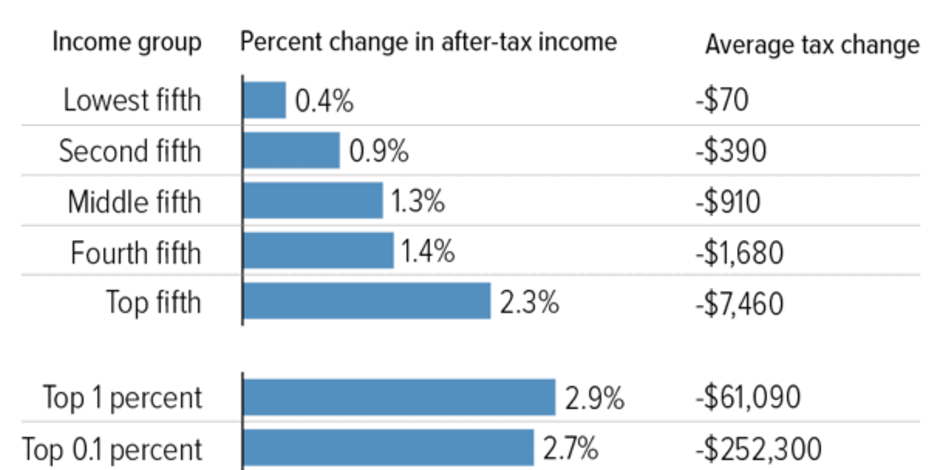

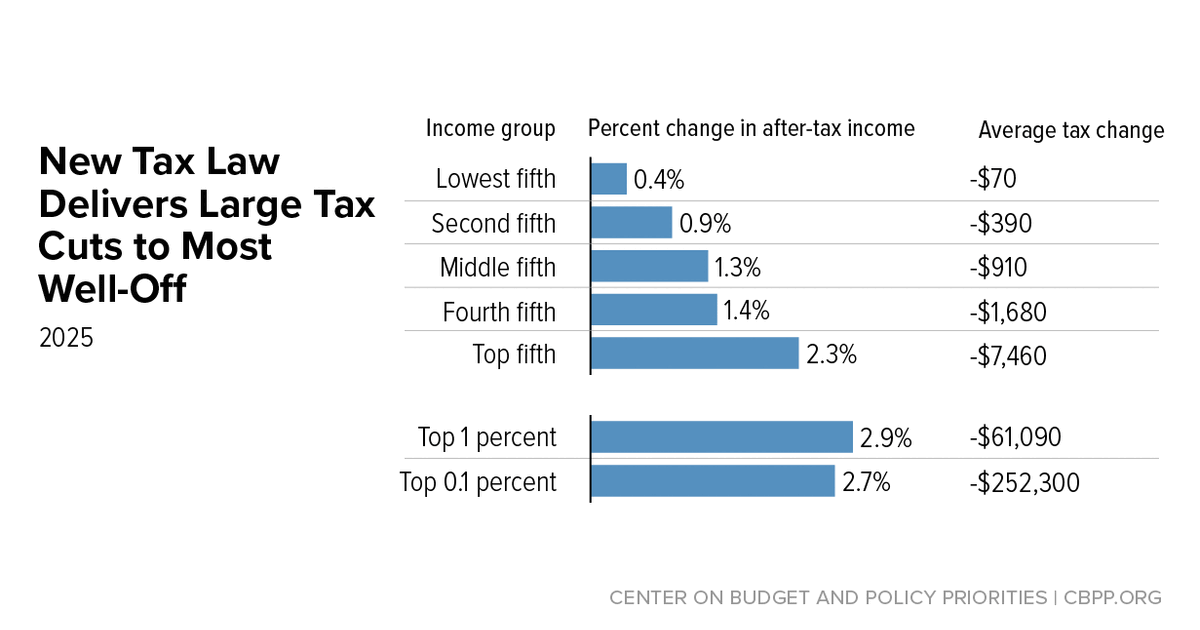

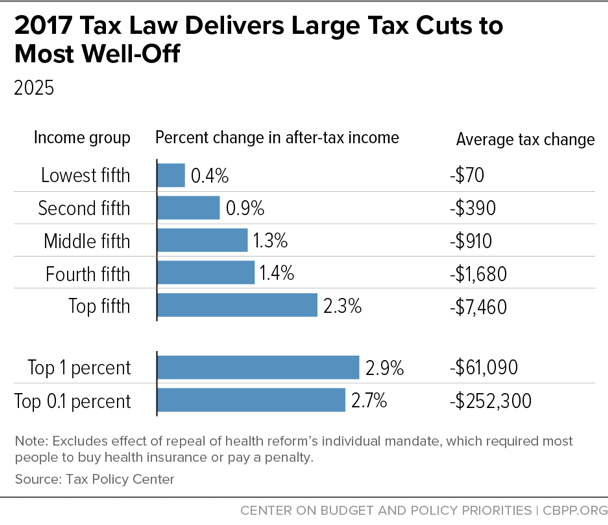

The major tax legislation enacted in December 2017 will cost about $1.9 trillion over ten years and deliver windfall gains to wealthy households and profitable corporations, further widening the gap

This is the biggest year-end tax issue for high-net-worth clients

Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio

Do the rich pay their fair share?

This is the biggest year-end tax issue for high-net-worth clients

The sales tax deduction: Know what it is, how to use it, and if

Guide to Amicus Briefs Filed in Moore v. United States

Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio

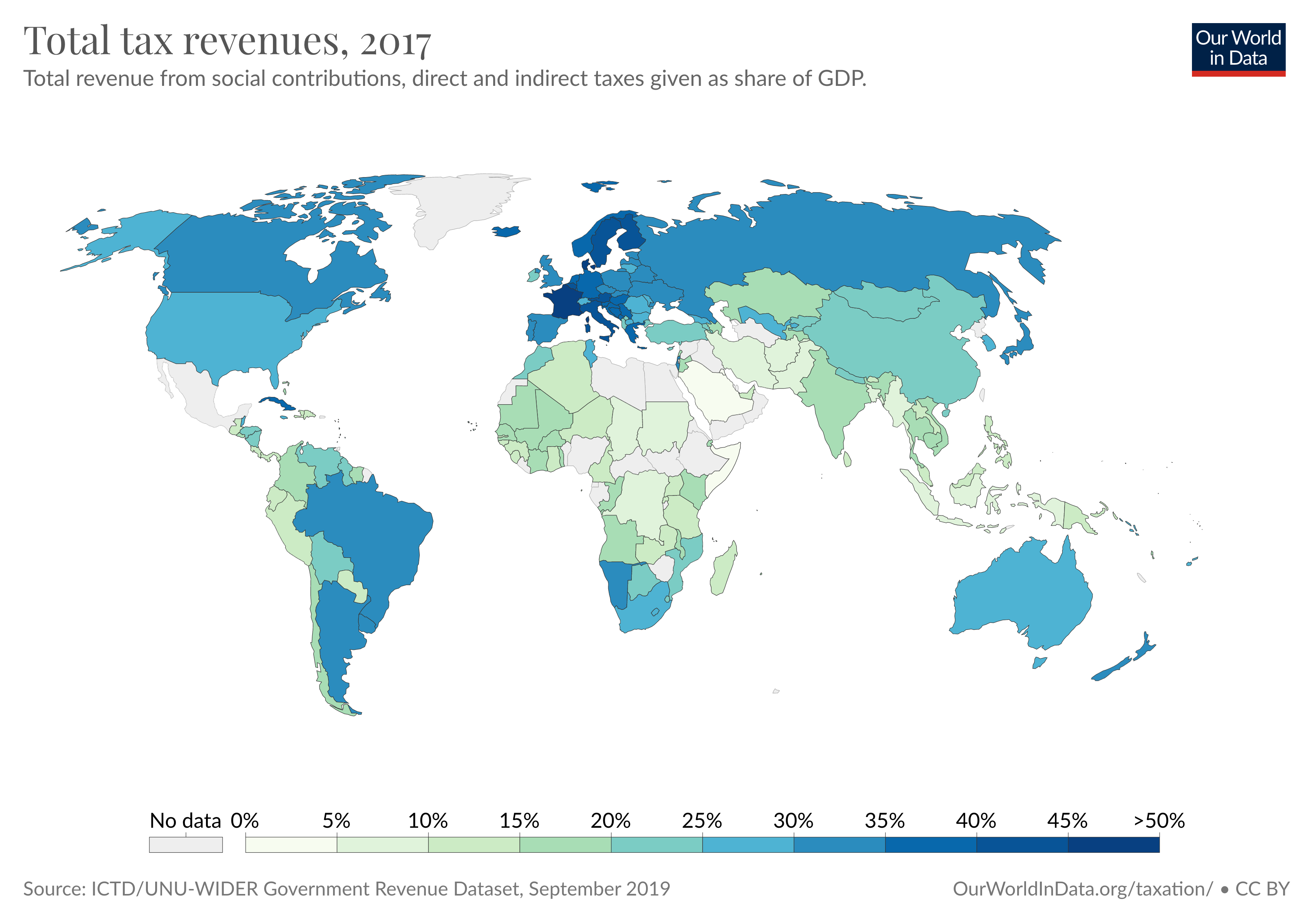

Taxation - Our World in Data

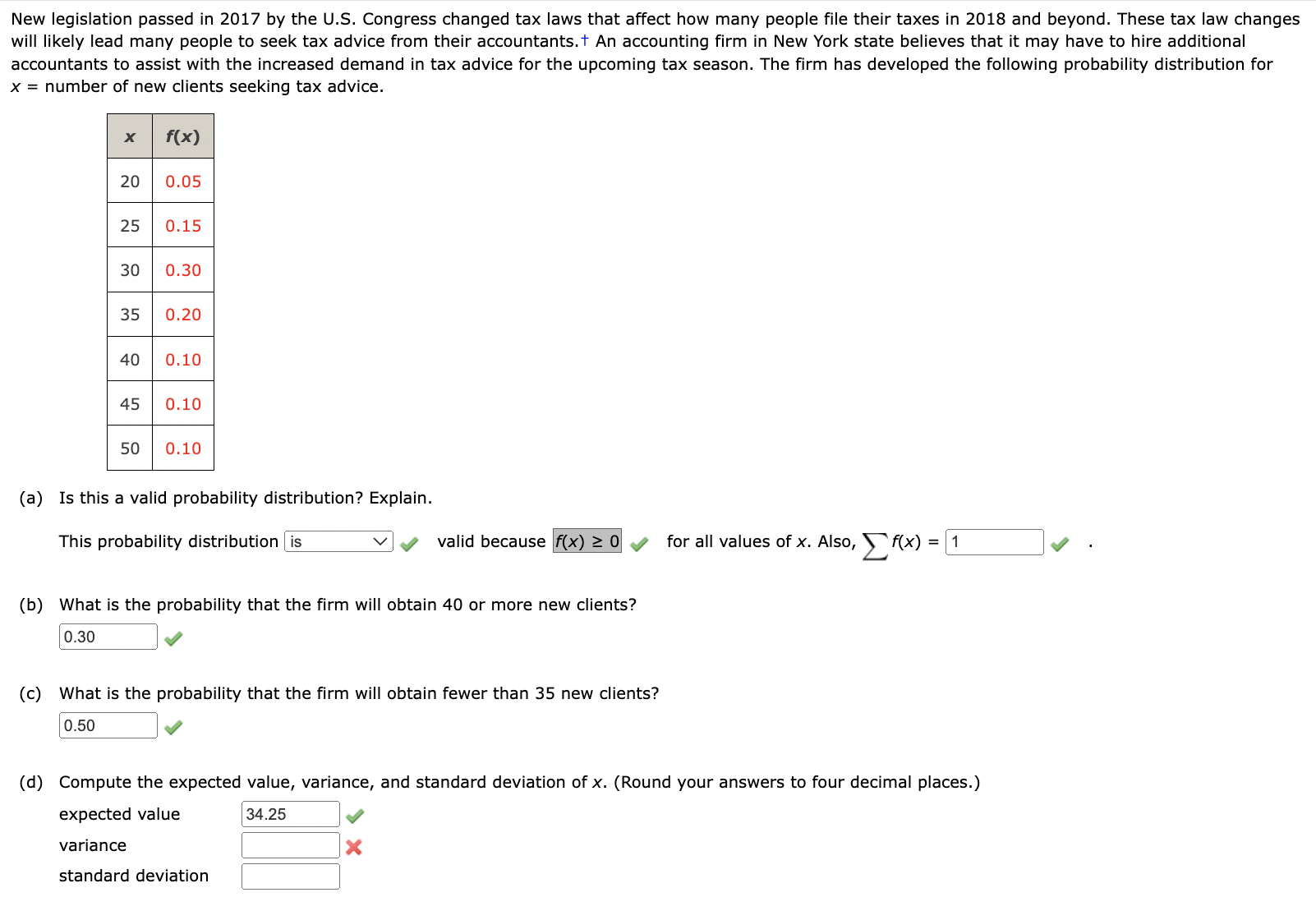

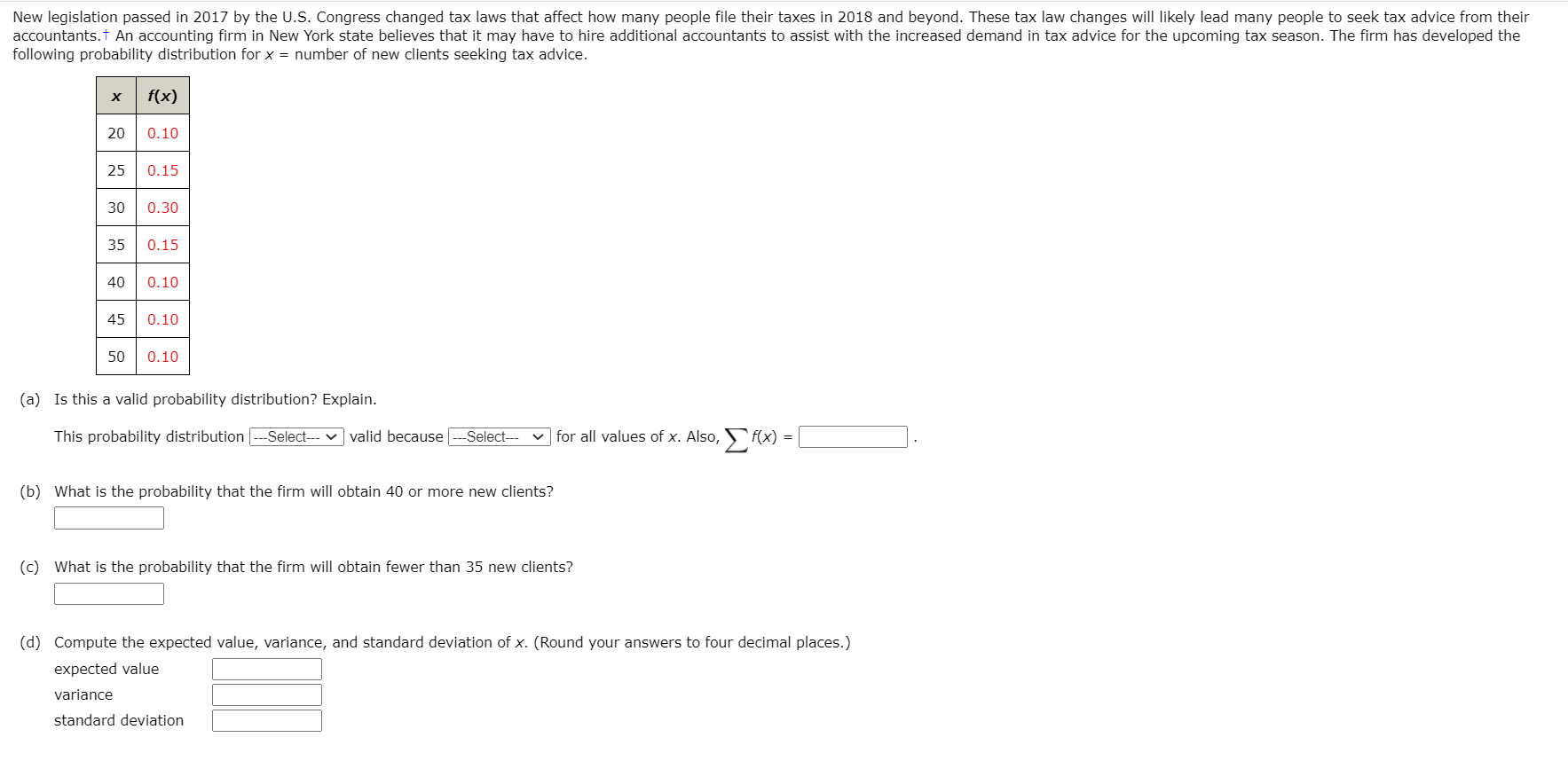

Solved New legislation passed in 2017 by the U.S. Congress

Fundamentally Flawed 2017 Tax Law Largely Leaves Low- and Moderate

TPC: Impacts of 2017 Tax Law's SALT Cap and Its Repeal

Solved New legislation passed in 2017 by the U.S. Congress

Property taxes are twice as high in poor neighborhoods as rich ones

2017 Tax Law Is Fundamentally Flawed

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A History of U.S. Tax Law Changes

Recomendado para você

-

Urban Dictionary Store22 dezembro 2024

Urban Dictionary Store22 dezembro 2024 -

How to pronounce qwertyuiopsdfghjklzxcvbnm22 dezembro 2024

How to pronounce qwertyuiopsdfghjklzxcvbnm22 dezembro 2024 -

qwertyuiopasdfghjklzxcvbnm22 dezembro 2024

qwertyuiopasdfghjklzxcvbnm22 dezembro 2024 -

Image result for22 dezembro 2024

Image result for22 dezembro 2024 -

Nintendo squashes browser-based Mario tribute game22 dezembro 2024

Nintendo squashes browser-based Mario tribute game22 dezembro 2024 -

New posts in Memes - Five Nights at Freddy's Community on Game Jolt22 dezembro 2024

New posts in Memes - Five Nights at Freddy's Community on Game Jolt22 dezembro 2024 -

All New Funny Pics Thread - Clean Edition - Page 163 - Off Topic22 dezembro 2024

All New Funny Pics Thread - Clean Edition - Page 163 - Off Topic22 dezembro 2024 -

Christine Dobbelaere (christinedobbelaere) - Profile22 dezembro 2024

Christine Dobbelaere (christinedobbelaere) - Profile22 dezembro 2024 -

I hate QR codes22 dezembro 2024

-

How to Pronounce Qwertyuiopasdfghjklzxcvbnm?22 dezembro 2024

How to Pronounce Qwertyuiopasdfghjklzxcvbnm?22 dezembro 2024

você pode gostar

-

O MELHOR MÉTODO PARA BAIXAR O WINDOWS 11 GRÁTIS (Atualizado)22 dezembro 2024

O MELHOR MÉTODO PARA BAIXAR O WINDOWS 11 GRÁTIS (Atualizado)22 dezembro 2024 -

How To Play Candy Crush Saga Online With Friends Tutorial22 dezembro 2024

How To Play Candy Crush Saga Online With Friends Tutorial22 dezembro 2024 -

North Star Games Wits & Wagers Board Game Deluxe Edition - Kid Friendly Party Game and Trivia NSG-110 - Saga Concepts22 dezembro 2024

North Star Games Wits & Wagers Board Game Deluxe Edition - Kid Friendly Party Game and Trivia NSG-110 - Saga Concepts22 dezembro 2024 -

Subway Surfers- What's your high score? by SnowPanda228 on DeviantArt22 dezembro 2024

Subway Surfers- What's your high score? by SnowPanda228 on DeviantArt22 dezembro 2024 -

O Esquadrão Spearhead 86 EIGHTY-SIX (Dublado)22 dezembro 2024

O Esquadrão Spearhead 86 EIGHTY-SIX (Dublado)22 dezembro 2024 -

Stream Download Chicken Gun 1.0.3 and unleash your inner rooster by Sculbibezo22 dezembro 2024

Stream Download Chicken Gun 1.0.3 and unleash your inner rooster by Sculbibezo22 dezembro 2024 -

Candy Crush Mixed Fruit Gummies - Shop Candy at H-E-B22 dezembro 2024

-

💖 PERDIÓ LA MEMORIA PERO ENCONTRÓ EL AMOR, GOLDEN TIME22 dezembro 2024

💖 PERDIÓ LA MEMORIA PERO ENCONTRÓ EL AMOR, GOLDEN TIME22 dezembro 2024 -

Watch Darker Than Black season 1 episode 2 streaming online22 dezembro 2024

Watch Darker Than Black season 1 episode 2 streaming online22 dezembro 2024 -

Download map Undertale Sans Fight for Minecraft Bedrock Edition 1.13 for Android22 dezembro 2024

Download map Undertale Sans Fight for Minecraft Bedrock Edition 1.13 for Android22 dezembro 2024